6 STEPS TO OPEN BANK ACCOUNT UNDER PRIME MINISTERS JAN-DHAN YOJNA

http://impnotice.blogspot.com/2014/08/6-steps-to-open-bank-account-under.html

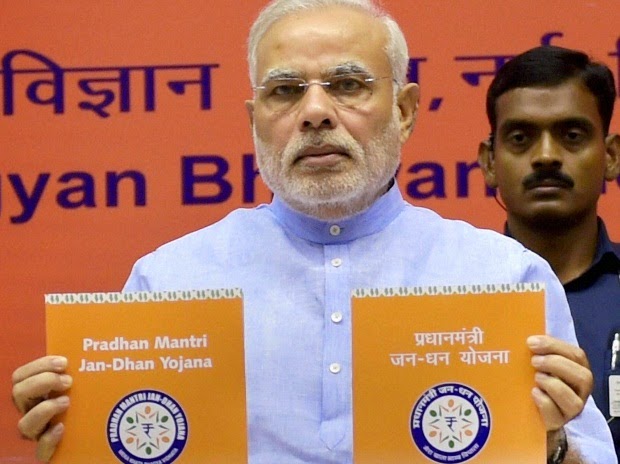

"JAN-DHAN YOJNA" :

We are having these 6 easy steps to open the account :

1. How to open bank account :

The initial step is very easy.To open a bank account under "JAN - DHAN YOJNA" , one must have Id and address proof and a photograph.

2. Id and address proof includes :

People can use any of the documents listed below as Id and address proof :

-> Passport

-> Driving License

-> PAN card

-> UID Card

-> NAREGA card

If any card in above list contains your address proof too, then you can use that one card only.

3. If your Address proof is having old address :

If it happens then also you can open account.Only one step to be followed that for further communication with bank, just provide your new address with address proof's copy.

4. Why Banks need Id and address proof :

To have all the necessary information of customer banks have rights under KYC (Know your customer ) Act to take Id and address proof from their customers.

5. If you don't have Id proof :

Even if you don't have Id proof and still you want to open a bank account, then also you can.This account will be called as "Small Account" and for this only photograph will be required.And the person has to provide his or her signature or thumb impression in front of Bank officer.

Small Account will have some limitations such as :

- Small account can not have more than Rs.50000

- Loan amount in one year should not exceed Rs. 1 Lac

- Total withdrawal per month should not be more than Rs. 10000

6. If anyone is not willing to have these limitations then :

If a person does not have Id and address proof and also don't want the above limitations in his/her banking, in this condition you can open bank account only in the case if bank will count you as "Low risk customer" and for this one has to submit a copy of one of the documents listed below :

- Photo ID card provided/issued by -

Central or state government, regulatory authorities, public sector undertakings, schedule commercial bank or public financial institutions.

OR

Letter with attested photograph of person provided by gazetted officer.ank

Run to nearest branch to you to open a bank account in Nationalized Bank just for no initial amount.What are your views for Jan-Dhan Yojna.Do share with India Forbes.